School Funding Fairness: A Look at Education Funding Inequity in New Hampshire

“Students as well as taxpayers have very different experiences, depending on where they live.”

A recent ruling from Rockingham Superior Court Judge David W. Ruoff found that the state provides “unconstitutionally low” funding for special education, forcing local communities to fill the gaps through local property taxes. The result highlights the unequal system in New Hampshire, in which educational opportunities and fiscal burdens vary across the Granite State, often impacting those least able to absorb the costs.

The New Hampshire Center for Justice & Equity (NHCJE) spoke with Carly Prescott, Policy Analyst, for the NH School Funding Fairness Project (NHSFFP), about how the organization works to make school funding equitable for students and taxpayers alike, through data analysis, public reporting, and advocacy.

Uncovering Funding Gaps in Education

According to a NH School Funding Fairness Project 2024 report, 70% of all public education funding in New Hampshire comes from local property taxes, while the remaining 30% comes from the State and Federal Governments. For wealthier communities with a strong tax base and high property values, costs are challenging but manageable. For property-poor districts that are already stretched thin, this can mean that needs go unmet.

The report confirms that relying on local property taxes to fund New Hampshire's education system creates disparities that disproportionately affect students who need the most support, particularly those who rely on special education services. "Students as well as taxpayers have very different experiences, depending on where they live," stated Prescott.

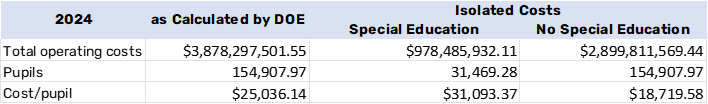

During the 2023-24 school year, 1 in 5 students in New Hampshire's public schools received services under an Individualized Education Program (IEP), totaling about 31,469 students. Beyond classroom accommodations, special education funding covers paraprofessionals, speech-language pathology, occupational therapy, and transportation, among other services. The State provided school districts with an additional $2,185 per student with an IEP, but the actual per-pupil cost is closer to $31,000, forcing taxpayers to close the gap.

Table 1. Costs of education per pupil. Source: NHSFFP’s 2024 Report.

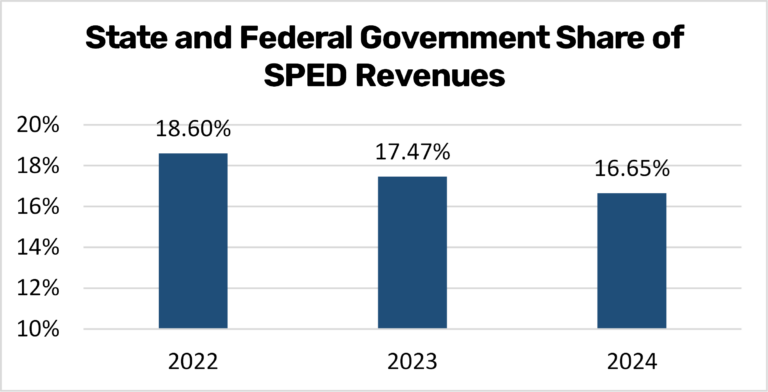

Figure 1. Decline of State and Federal government’s share of special education funding over the past 3 years.

Source: NHSFFP’s 2024 Report.

In 2024, local property taxes funded 83.35% of special education revenues, while only 16.65% of the actual costs of these services were covered by the legally mandated State and Federal funds, shifting the majority of costs onto local communities. “That downshifting of costs onto local property taxpayers continues every year,” Prescott said. “And it just exacerbates the inequities from district to district.”

“... downshifting of costs onto local property taxpayers continues every year. And it just exacerbates the inequities from district to district.”

Rising Costs Outpace Funding

Special education is a federal right rooted in mandates such as the 50-year-old Individuals with Disabilities Education Act (IDEA), which requires public schools to provide a free and appropriate education tailored to each student's needs. "We should be doing everything we can to make sure that they get that, as well as every other student, regardless of where they live," Prescott emphasized.

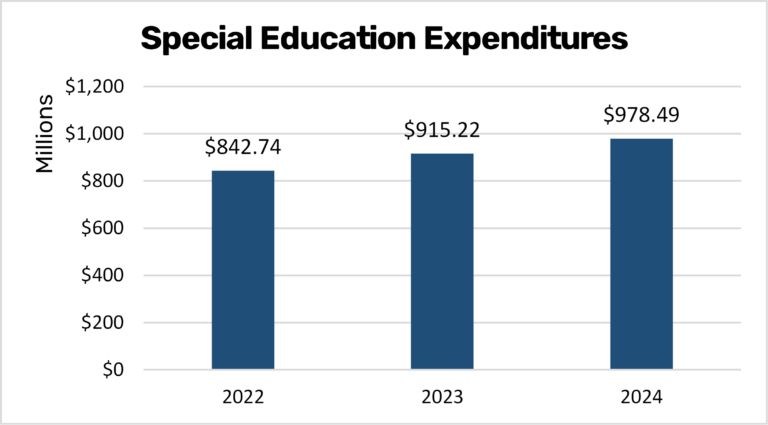

NHSFFP’s report also found that the costs of special education are rising at more than three times the rate of general education expenses, exacerbating inequity. New Hampshire taxpayers contributed nearly $3.88 billion to public education in the 2023-24 school year. A quarter of those contributions, $978 million, was allocated to disability services, reflecting a 6.91% increase from the previous year.

Figure 2. Increases in special education expenditures over the past 3 years.

Source: NHSFFP’s 2024 Report.

"There are 70 out of 176 districts in New Hampshire that spent over 25% of their budget on special education in 2024," Prescott noted. “This squeeze on district budgets affects all students, not just those with disabilities, as it makes it harder to balance budgets for general education programs, teacher salaries, building maintenance, or enrichment activities.”

As Prescott emphasized, the challenge is to surface the actual cost of providing legally required services without framing students with disabilities as a burden. The issue is not the students themselves, but a funding system that fails to adequately distribute resources.

“This squeeze on district budgets affects all students, not just those with disabilities, as it makes it harder to balance budgets for general education programs, teacher salaries, building maintenance, or enrichment activities.”

Alternatives to a Regressive Tax System

New Hampshire's current tax funding structure is regressive, meaning that lower- and middle-income households pay a higher percentage of their income in taxes than wealthier households. "Over 70% of New Hampshire's school students live in districts that are below the average property tax base," Prescott explained.

And despite not having a sales tax or a state income tax, New Hampshire has the highest state and local property tax collection in the country, averaging $3,660 per capita, and the fourth-highest effective property taxes, with an effective real estate tax rate of 1.77%.

Alternative revenue sources to fund the public education system could benefit around 70% of the state, relieving the average property tax burden while ensuring schools are more equitably funded across the state. “There is no true revenue source big enough to fund public education besides a property tax, a sales tax, or an income tax, which constantly meets resistance in the State House," Prescott acknowledged.

“There is no true revenue source big enough to fund public education besides a property tax, a sales tax, or an income tax, which constantly meets resistance in the State House,”

Slow Budget Reform and Federal Cuts Compound Challenges

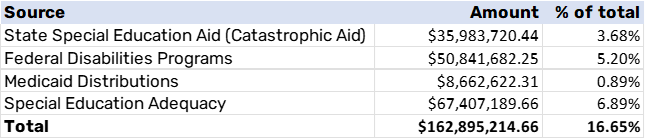

The last legislative session has brought minimal progress, but the broader funding structure remains unchanged. “The state's Special Education Aid program now requires reimbursement of up to 80% of costs that exceed three times the average cost per pupil,” stated Prescott. And while this can address the most extreme cases, in 2023-24, New Hampshire Special Education Aid distributed only $35.9 million, about 3.68% of the total $978 million spent on disability services statewide.

Table 3. Monies received by school districts from the Federal and State governments to support IEP programs for 2023-2034. This includes the State Special Education Aid. Source: NHSFFP’s 2024 Report.

Additionally, a House budget proposal to increase special education adequacy funding from $2,185 to just over $3,000 failed to pass the Senate in 2025, leaving the already inadequate rate unchanged. "By bringing those averages back up, school districts could really prepare and budget appropriately for what their students need."

At the same time, federal cuts and rollbacks on Diversity, Equity, and Inclusion (DEI) initiatives compound these challenges. The offices responsible for overseeing compliance with special education laws were affected by recent large-scale layoffs within the Department of Education, posing an additional threat to the 7.5 million students with disabilities across the country. And the harmful rhetoric framing equity as preferential treatment ignores that for students with disabilities, accommodations are necessary to participate in education at all. And all students benefit from being in a school that fully includes all students.

Advocating for Fairness

The NH School Funding Fairness Project continues to document how education costs are increasingly shifted onto local property taxpayers, widening the gaps between districts across New Hampshire. A forthcoming report will take a closer look at out-of-district placements and unreimbursed special education costs, offering a clearer picture of the pressures faced by school districts.

Addressing these inequities will require legislative action, either through alternative revenue sources such as a sales or income tax, or through a stronger commitment to funding public education from existing sources. In the meantime, NHSFFP is focused on laying the groundwork for the 2027 budget cycle to secure more stable and equitable funding for schools.

Without meaningful reform, New Hampshire will continue to underfund education in general, particularly special education, placing disproportionate strain on local communities with limited tax revenue. By making these disparities visible, the NH School Funding Fairness Project strengthens the case for a system that serves every student, regardless of their ZIP code.

Learn more about school funding in NH- Read the NH School Funding Fairness Project’s Research:

About Carly Prescott

Carly Prescott. Image Credits: NHSFFP website.

Carly Prescott is a Policy Analyst with the NH School Funding Fairness Project, where she researches and analyzes the state’s public education funding system and its impact on students, taxpayers, and communities. Carly earned a Master of Public Policy from the Carsey School of Public Policy, where she worked as a Social and Fiscal Policy Fellow researching housing, food security, and civic engagement, before joining NHSFFP in 2022. She previously interned for U.S. Senator Jeanne Shaheen and Congresswoman Ann McLane Kuster. She also serves on the Somersworth School Board.